Profitability of the project

Products

When the design capacity is reached in 2025, the annual output will be 14 thousand tonnes of frozen French fries. It is planned to sell about 7 thousand tonnes annually on the domestic market and about 7 thousand tonnes to the border regions of the Russian Federation.

Project

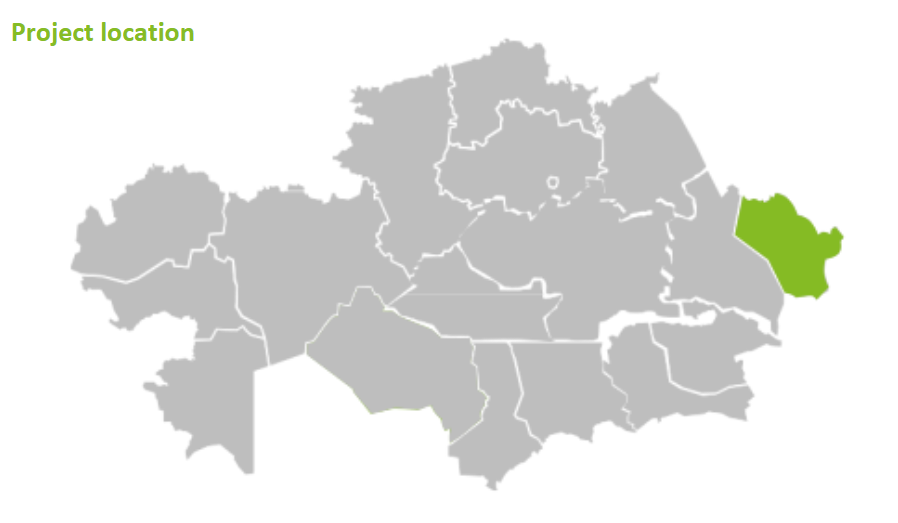

This investment project involves the construction of a 20,000 tonne per annum potato processing and frozen French fries production plant in the East Kazakhstan region. The plant will be built on a plot of land with a total area of 16 hectares. The implementation of the project will allow the following tasks to be carried out

Create capacity for the production of import substitution products;

Increase the region's export potential;

- Create more than 30 jobs.

Initiator

Akimat of East Kazakhstan region

Market

- Growing demand and the impact of global taste preferences. The volume of international purchases of processed potatoes in 2021 was 4 013 mlrd. tenge. The average annual growth rate over the last 5 years was 3.6%.

Investment attractiveness of the project:

The amount of investments is 56 912 mln. tenge

NPV -69 500 mln. tenge

IRR -48.2%

The payback period of the Project is 3,5 years

What is the attractiveness of the project?

- Proximity to raw material base. The key factor in the location of production is proximity to the raw material base. East Kazakhstan is one of the traditional potato growing regions (260 thousand tonnes of potatoes are harvested annually). In addition, more than 1091.0 thousand tonnes of potatoes are grown annually in the Pavlodar, Abai and Dzhetysui regions.

- Proximity to the consumer market. The region of production is characterised by extensive road transport and logistics infrastructure, which minimises both the time and cost of delivery of finished products to large cities of Kazakhstan and border regions of the Russian Federation.

Investment proposal

The project requires financing of

56 912 mln. tenge, of which

70% (39 838 mln. tenge) - debt financing (if security is available) or investor participation;

30% (17 073 mln. tenge) - investor equity.

The proposed financing structure and government support measures are indicative, the final structure of financing and participation in the project will be determined based on the results of joint negotiations with the investor.